Double declining method formula

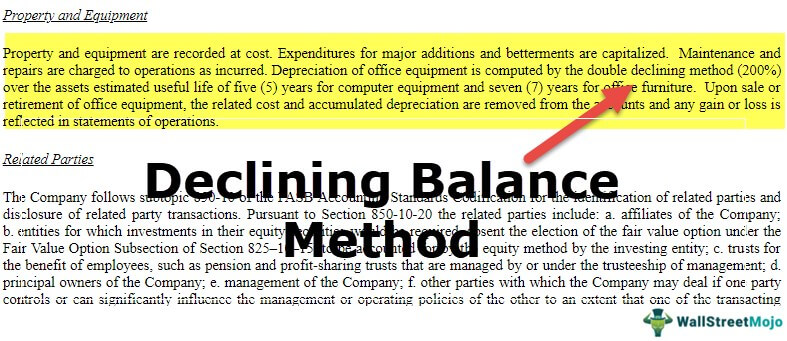

Similar to the declining balance method the double-declining balance depreciation method is also an accelerated depreciation system used in business accounting to determine the accumulated depreciation of an asset. The accelerated depreciation rate to be used in the declining balance method will.

Double Declining Balance Method Of Depreciation Accounting Corner

This accounting system depreciates assets twice as quickly as the basic declining.

. It is a method of distributing the cost evenly across the useful life of the asset. Double-declining balance depreciation method. The following is the formula.

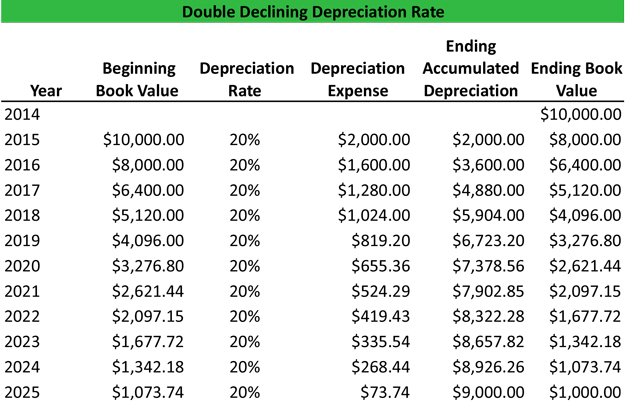

Our formula would look like this. Calculate 150 Percent of the Straight-line Rate. The warehouse would depreciate by 110 or 10 percent each year.

It can also calculate partial-year depreciation with any accounting year date setting. The double declining balance method. If you are using the double declining balance method just select declining balance and set the depreciation factor to be 2.

Depreciation 5 million 1 million 10.

Depreciation Expense Double Entry Bookkeeping

Double Declining Balance Method Of Deprecitiation Formula Examples

Simple Tutorial Double Declining Balance Method Youtube

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Double Declining Balance Method Of Depreciation Accounting Corner

Double Declining Balance Depreciation Calculator

Double Declining Balance Method Of Depreciation Accounting Corner

What Is Double Declining Balance Method Of Depreciation Pmp Exam Accelerated Depreciation Youtube

Depreciation Methods 4 Types Of Depreciation You Must Know

/depreciation-accounting-2ad5d217d7cc49c396f4abfad537f7c2.jpg)

Double Declining Balance Ddb Depreciation Method Definition With Formula

Double Declining Balance Depreciation Daily Business

What Is The Double Declining Balance Method Definition Meaning Example

Double Declining Depreciation Efinancemanagement

How To Use The Excel Ddb Function Exceljet

Depreciation Formula Calculate Depreciation Expense

/double-declining-balance-depreciation-method-4197537-FINAL-9baf4fb736b74a1686dd768332f364b3.png)

Double Declining Balance Ddb Depreciation Method Definition With Formula